Blog

Nov 21, 2025

Can AI Stop Your Home Health Billing Errors?

Arvind Sarin

The most expensive notification in your inbox arrives on a Tuesday morning.

A claim denial.

Your billing manager sighs and opens the file and begins the forensic investigation. Was it a coding error? Was it a missing signature? Was there a contradiction between the OASIS assessment and the clinical notes?

They will spend the next three hours fixing a mistake that happened three weeks ago. This error will delay payment by 30 to 45 days and cost your agency an average of $25 to rework.

Multiply that across the 15 to 20% of home health claims that get denied on first submission and you are looking at tens of thousands of dollars in preventable losses every quarter.

This is the fundamental flaw of traditional home health revenue cycle management. It is designed to be reactive. Your billing team becomes a cleanup crew constantly looking in the rearview mirror to fix documentation gaps left behind by clinical staff.

But in an era of shrinking Medicare reimbursements under PDGM and increasing regulatory scrutiny you cannot afford to be reactive anymore.

You need to be defensive.

Here is why the post-claim billing model is killing your cash velocity and how AI is flipping the script to prevent denials before they happen.

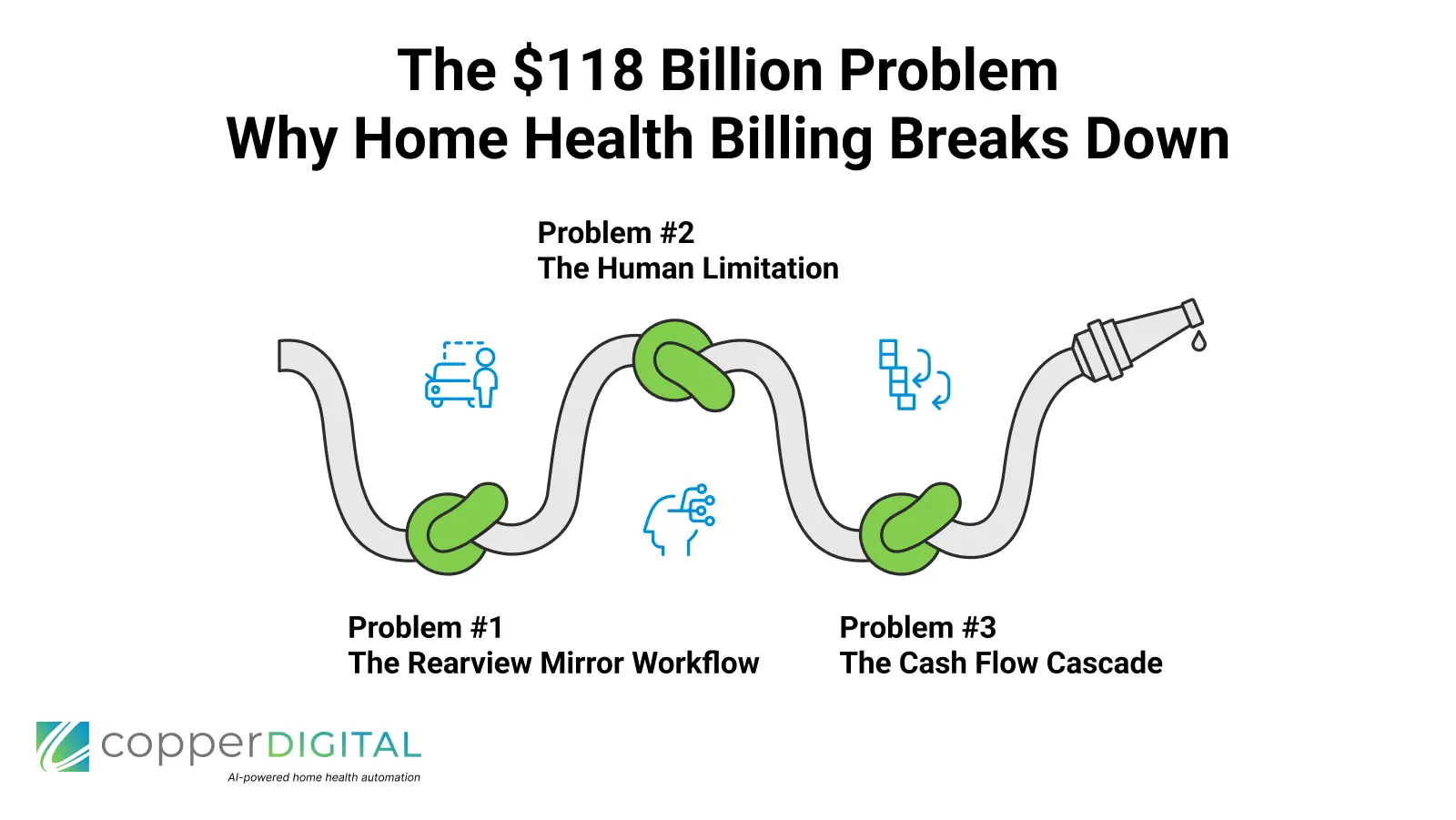

The $118 Billion Problem: Why Home Health Billing Breaks Down

Revenue cycle inefficiency costs the U.S. healthcare system over $250 billion annually with administrative complexity being the primary culprit. In home health specifically the problem intensifies due to several factors.

Complex coding requirements under PDGM's 30-day payment model

OASIS documentation that must align perfectly with ICD-10 codes

Payer-specific rules that vary between Medicare Advantage plans

Multi-week lag times between service delivery and claim submission

The result? According to industry benchmarks, 15-20% of home health claims are denied on first submission, with top denial reasons including:

Missing or insufficient documentation (32% of denials)

Medical necessity not established (28% of denials)

Coding errors or mismatches (18% of denials)

Authorization issues (12% of denials)

Eligibility problems (10% of denials)

Each denied claim costs an average of $25-$71 to rework, requires 15-30 days to resolve, and ties up working capital your agency needs for payroll and operations.

Problem #1 The Rearview Mirror Workflow

Think about your current workflow.

A nurse completes a skilled visit. The notes sit in the EMR for 2 to 5 days. A QA manager might review them. The biller codes and submits the claim. Then 7 to 14 days later a denial arrives.

If there is an error such as a mismatch between the diagnosis code and the visit notes or a functional assessment that does not support skilled need it is not caught until the very end of the line.

By the time your billing team spots the error the crime scene is cold. They have to chase down the nurse who completed the visit weeks ago and request an addendum. They must wait for clinical staff to find time to make corrections and then resubmit the claim.

This creates Billing Lag which is the silent killer of home health cash flow. Many agencies rely on lines of credit to make payroll while waiting 45 to 60 days for clean claims to pay.

Industry leaders who implement denial prevention strategies achieve claim acceptance rates of 85 to 95% on first submission. This cuts their days in accounts receivable from over 45 days to between 28 and 35 days.

Problem #2 The Human Limitation

Home health billing rules aren't just complex; they're volatile and payer-specific.

National Coverage Determinations and Local Coverage Determinations change quarterly. Medicare Advantage plans from Optum and Humana and Aetna each have unique documentation requirements. Add in state-specific Medicaid rules and you are asking human billers to memorize thousands of variables.

The reality? Even experienced billers make predictable mistakes:

They skim through 12-page OASIS assessments

They miss subtle inconsistencies between narrative notes and structured data

They don't catch when a nurse documents "patient ambulated 50 feet" in free text, but marks "bedfast, unable to ambulate" on the functional assessment.t

They can't keep up with the 400+ LCD updates CMS publishes annually

That single inconsistency your biller didn't catch because they reviewed 47 other charts that day becomes a medical necessity denial worth $2,000-$3,000 in lost revenue.

High-performing agencies recognize this isn't a training problem. It's a system design problem.

Problem #3 The Cash Flow Cascade

When billing is reactive the problems compound.

Reactive Billing Model

Claims submitted 10 to 14 days post-service

Payment delayed 2+ weeks

18% first-pass denial rate

18% of expected revenue delayed 30 to 45 days

Total Result 60 to 75 day payment cycle requiring credit lines

Defensive Billing Model

Real-time documentation auditing

Errors caught before claim submission

4 to 6% first-pass denial rate

94 to 96% of revenue arrives on time

Total Result 28 to 35 day payment cycle with predictable revenue

The difference is approximately 30 to 40 days of improved cash velocity. For a $5M agency this translates to over $400,000 in working capital freed up.

The Solution Defensive Documentation with AI

The agencies dominating home health in 2025 are not just billing faster. They are auditing sooner by catching errors before claims leave the building.

This is where AI-powered compliance automation changes the game.

Meet Maria.

Maria is Copper Digital's AI agent designed specifically for home health billing. Unlike a human biller who reviews files after they are closed Maria audits documentation in the moment a clinician saves their notes.

Here is how defensive documentation works.

1. The Logic Check Maria instantly scans the entire patient chart for inconsistencies across OASIS assessments and narrative notes and care plans. If a clinician marks a patient as high-risk for falls but fails to document a fall prevention intervention in the care plan Maria flags it immediately.

2. The Payer Filter Maria maintains an updated database of payer-specific requirements including Medicare LCD requirements and Medicaid guidelines. If a Medicare Advantage plan requires a physician's signature within 30 days of admission Maria flags any chart approaching day 28 without the signature.

3. The Medical Necessity Validator Maria analyzes whether documentation supports skilled need. Does the diagnosis support the therapy being provided? Are functional limitations documented? Maria ensures all elements are present before claim submission.

4. Zero Fatigue and 100% Coverage Unlike human reviewers who get tired after their thirtieth chart Maria reviews 100% of charts with 100% attention 24 hours a day. She never skims and applies the same rigorous standards to every single visit.

Real-World Implementation: From Accuracy to Velocity

When you deploy an AI agent like Maria inside your EMRwhether you use WellSky, Axxess, or KanTimeyou fundamentally transform your revenue cycle:

Before AI

Billing team reviews 200 charts/week

18% denial rate on first submission

Average 42 days to payment

Billing staff spend 60% of their time on rework

$127,000 in monthly cash flow tied up in A/R

After AI

AI reviews 100% of charts in real-time

5% denial rate on first submission

Average 31 days to payment

Billing staff focuses on complex cases and payer relations

$84,000 in monthly cash flow freed up

The result isn't just higher accuracy in cash velocity. By eliminating the back-and-forth between billers and nurses, you dramatically shorten the time from "Visit Completed" to "Cash in Bank."

Leading agencies report

60% reduction in administrative costs related to rework

23% improvement in days in A/R

$180,000-$340,000 annual ROI for mid-sized agencies (150-300 visits/month)

How to Implement Defensive Documentation

The shift to defensive billing does not require ripping out your entire tech stack. Here is the roadmap.

Phase 1 Assessment Audit your current denial patterns. Identify the top 5 denial reasons. Measure current days in A/R and calculate the cost of rework.

Phase 2 AI Integration Deploy an AI agent with read-only EMR access. Configure payer-specific rules and set up real-time alerts for clinical staff.

Phase 3 Process Optimization Move to same-day chart review workflows. Empower clinicians to fix flagged items before submission. Transition the billing team from rework to strategic denial management.

Phase 4 Continuous Improvement Conduct monthly reviews of denial trends. Update payer rules quarterly and expand to additional use cases like prior authorization.

FAQ: AI in Home Health Billing

Will AI replace our billing team?

No. AI handles repetitive review tasks, freeing your billing team to focus on complex cases, payer negotiations, and revenue strategy. Think of it as hiring a tireless assistant who never misses a detail.

How long does implementation take?

Most agencies see initial results within 30-45 days and full ROI within 90-120 days.

What about EMR compatibility?

Modern AI solutions integrate with major home health EMRs, including WellSky, Axxess, KanTime, and others via API connections.

Does this require changes to clinical workflows?

Minimal. Clinicians receive alerts within their normal workflow need to access a separate system.

What if our denial rate is already below 10%?

Even high-performing agencies benefit from reduced rework time, faster cash cycles, and freed-up staff capacity for growth initiatives.

Stop Fighting Denials. Prevent Them

Your billing team should not spend its days fighting a losing battle against paperwork errors and missing documentation. They should be focused on high-level revenue strategy including payer negotiations and contract optimization.

The traditional revenue cycle was built for a slower and less complex era. PDGM changed the game by requiring 30-day episodic thinking and functional assessment coding that humans struggle to keep straight.

Defensive documentation is the competitive advantage that separates growing agencies from those stuck in reactive mode.

Stop looking in the rearview mirror. Let Maria watch the road ahead.

Ready to transform your home health billing from reactive to defensive? Schedule a demo with Copper Digital to see Maria in action and calculate your agency's ROI.