Blog

Dec 3, 2025

How Value-Based Purchasing is Reshaping the Home Healthcare Agency Model

Arvind Sarin

For decades, the relationship between hospitals and post-acute providers was strictly transactional. You sent a patient to a home healthcare agency, they performed the visits, and they billed Medicare. As long as the visits occurred, the financial loop was closed.

That era is officially over.

The release of the long-awaited evaluation of the original Home Health Value-Based Purchasing (HHVBP) Model has fundamentally rewritten the economic rules of our sector. The data, covering six years of performance from 2016 to 2021, paints a picture of a massive structural shift that many in the industry have yet to fully internalize.

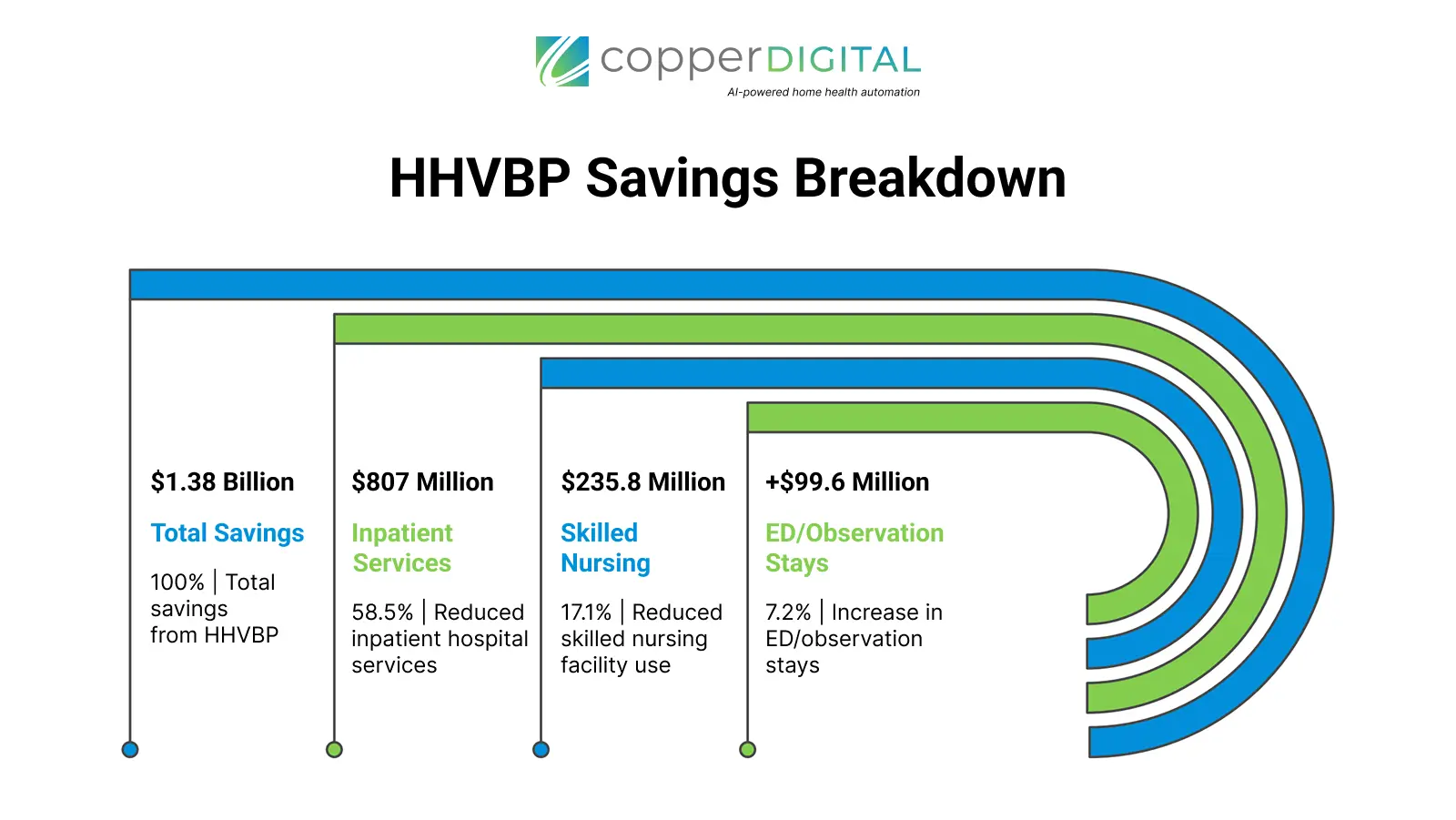

The headline number is impossible to ignore. The model generated $1.38 billion in cumulative Medicare savings.

But for discharge planners and payer partners, the total savings figure is less important than how those savings were achieved. The data reveals that high-performing agencies are no longer just service providers. They have evolved into cost-containment engines that actively substitute expensive inpatient care for efficient home-based monitoring.

The Anatomy of $1.38 Billion in Savings

To understand the value of your post-acute network, you have to look at where the money stopped flowing. The savings did not come from a reduction in home health utilization itself. In fact, home health spending decreased only marginally.

The massive financial windfall came from a dramatic reduction in acute care utilization. The evaluation found that $807 million of the total savings came specifically from reduced spending on inpatient hospital services. An additional $235.8 million was saved by reducing Skilled Nursing Facility (SNF) utilization.

This creates a clear narrative for hospital administrators: The agencies winning under this model are those capable of keeping high-acuity patients out of the hospital bed and out of the nursing home.

Interestingly, the data shows a sophisticated "substitution effect" at play. While inpatient spending plummeted, there was a recorded increase of $99.6 million in outpatient Emergency Department (ED) and observation stays. At first glance, an increase in ER visits seems negative. However, in the context of massive inpatient savings, this indicates that agencies are successfully managing acute exacerbations. They are catching issues early, utilizing the ED for stabilization, and returning the patient home rather than admitting them for a costly multi-day inpatient stay.

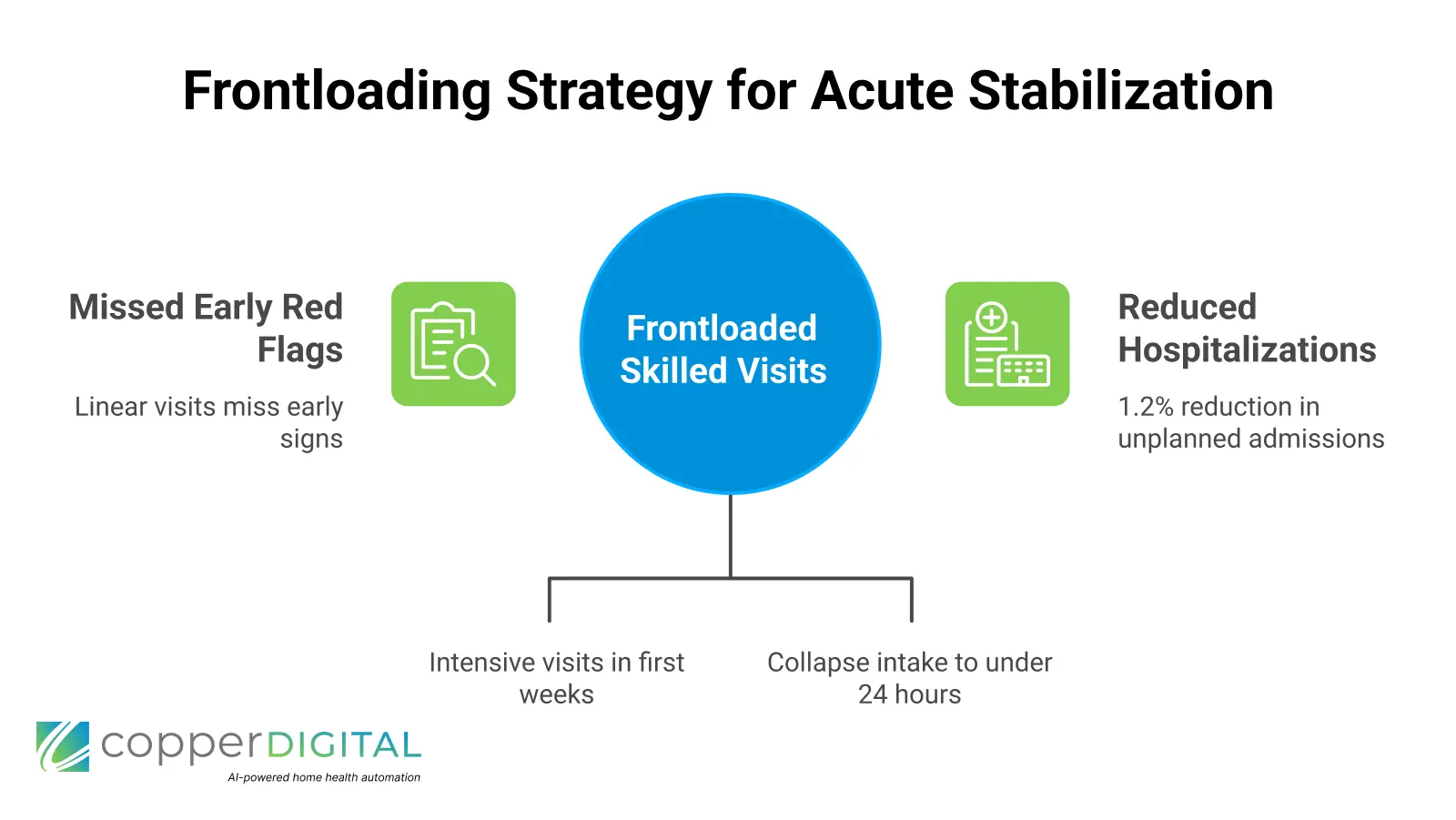

The "Frontloading" Strategy: How the Care Plan Has Changed

Achieving these results required agencies to completely overhaul their operational logic. The "Old Way" involved a linear care plan—perhaps scheduling two nursing visits a week for nine weeks. That passive approach is now a liability.

The report highlights that successful agencies adopted a clinical strategy known as "frontloading". This involves stacking skilled nursing and therapy visits heavily in the first two weeks of the episode immediately following discharge.

By increasing touchpoints during the most vulnerable post-acute window, agencies can identify medication discrepancies, fall risks, and wound complications before they spiral into readmissions. The data confirms this approach works, showing a 1.2% reduction in unplanned hospitalizations among fee-for-service beneficiaries.

However, frontloading presents a significant operational challenge that separates sophisticated partners from the rest of the pack. You cannot frontload care if you cannot process the referral instantly.

As we discussed in our analysis of referral management bottlenecks, agencies stuck in manual intake workflows often take 48 hours just to process a patient into their system. By the time they are ready to schedule that first "frontloaded" visit, the critical window has already closed. The agencies capable of delivering on the promise of HHVBP are those using automation to collapse that intake timeline, ensuring the first clinician is in the home within 24 hours of discharge.

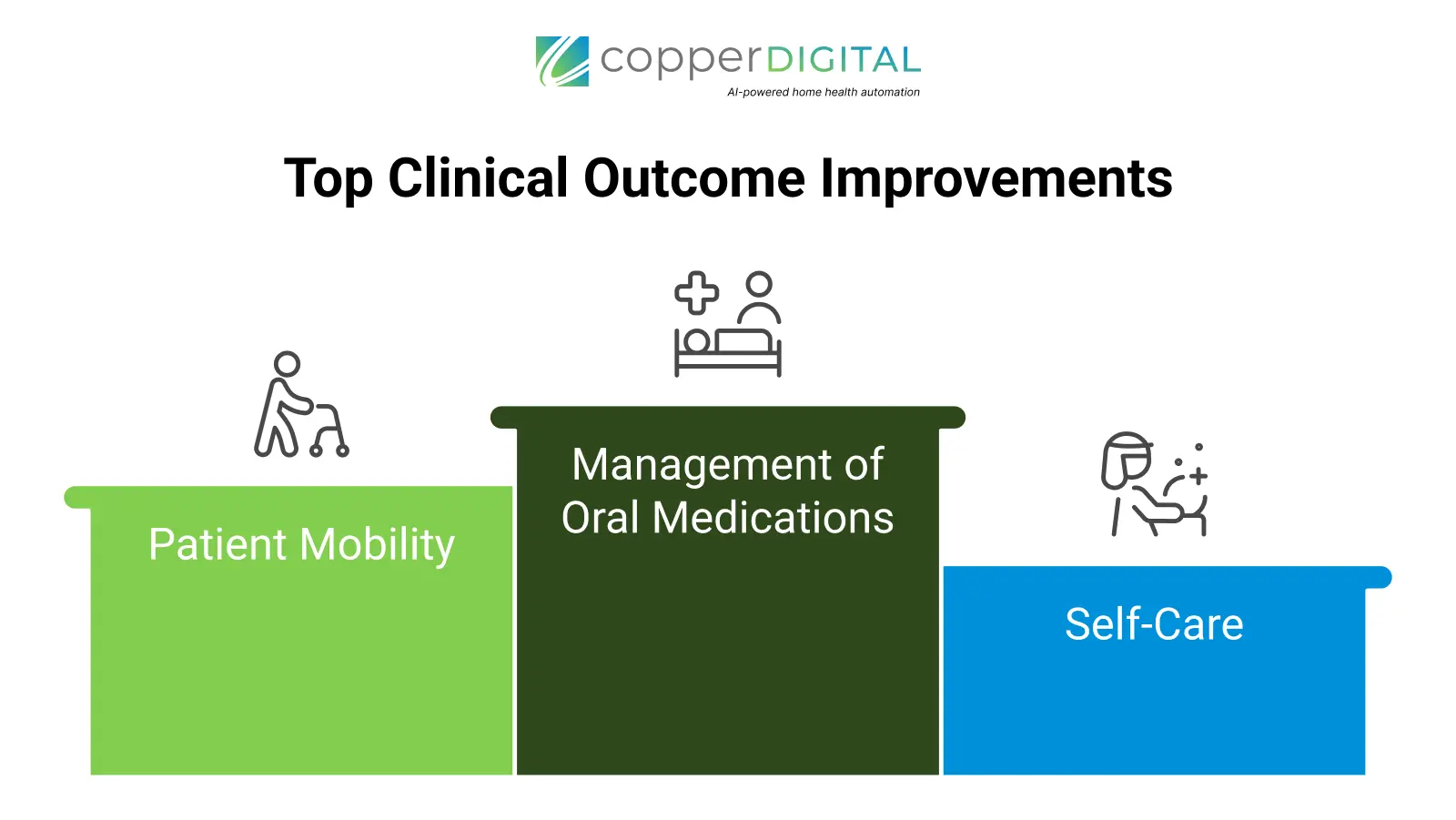

Clinical Outcomes as Business Assets

For our payer and hospital partners, clinical improvements are often viewed as abstract "quality" metrics. Under HHVBP, they are concrete business assets that protect your margins.

The evaluation found that the model drove statistically significant improvements across key functional domains. Most notably, improvement in the management of oral medications increased by 4.4%.

Consider the downstream impact of that single metric. Medication errors are a leading cause of hospital readmissions, particularly for heart failure and diabetic patients. Partnering with a home healthcare agency that demonstrates a 4.4% lift in medication adherence is not just a clinical decision; it is a risk mitigation strategy for your hospital's readmission penalty exposure.

Furthermore, the data showed consistent gains in patient mobility (2.3% increase) and self-care (2.9% increase). These are not just numbers on a spreadsheet. They represent patients regaining independence faster, requiring fewer long-term resources, and exiting the expensive cycle of institutional care.

Achieving these scores requires more than just good nurses; it requires accurate data. As outlined in our guide to improving clinician capacity, agencies using AI-driven OASIS scrubbing can identify these clinical risks in real-time, ensuring the care plan matches the patient's actual acuity level.

The Hidden Risk of "Low Quality" Networks

Perhaps the most concerning finding in the report revolves around access and equity. The data suggests that the benefits of high-quality home health are not being evenly distributed, creating a potential liability for referral networks that do not actively manage their agency partners.

The evaluation found that racial and ethnic minority beneficiaries were significantly more likely to use lower-quality agencies—defined as those with a Quality of Patient Care Star Rating of 3 or fewer—compared to White beneficiaries. This disparity persisted throughout the model's duration.

For hospital systems committed to health equity, this is a red flag. It implies that simply sending a referral to the "next available" agency may inadvertently steer vulnerable populations toward sub-par providers.

The report also identified a "critical mass" phenomenon. Counties that performed well in both quality and equity tended to be served by a market where at least 25% of the agencies held a 4-Star Rating or higher. This suggests that partner selection matters immensely. Hospitals must actively curate their post-acute networks, prioritizing agencies that invest in the technology and training required to achieve 4 and 5-star outcomes.

The Future of the Partnership

The expansion of HHVBP to all 50 states means that the metrics driving these $1.38 billion in savings are no longer experimental. They are the new standard.

In this environment, the "Care Plan" is no longer just a schedule of visits. It is a financial instrument. When executed correctly by a technologically enabled agency, it unlocks millions in savings by preventing unnecessary inpatient utilization.

Discharge planners and payers need to ask their home health partners tough questions:

Do they have the intake automation to support frontloading?

Do they use real-time data to monitor medication adherence?

Are they actively scrubbing their OASIS data to ensure the clinical picture is accurate?

The agencies that can answer "yes" are the ones generating that $1.38 billion. Everyone else is just billing for visits.

Is Your Network Optimized for Value? Contact Copper Digital for a Consultation